Business credit reports contain payment histories, legal filings, company details, and trade accounts that directly influence financing decisions, insurance rates, and vendor relationships for companies seeking growth opportunities.

Understanding business credit reports is critical for any company owner. These documents impact everything from loan approvals to insurance premiums and vendor payment terms. Without proper knowledge of the information appearing on these reports, businesses can find themselves at a disadvantage when negotiating favorable financial arrangements.

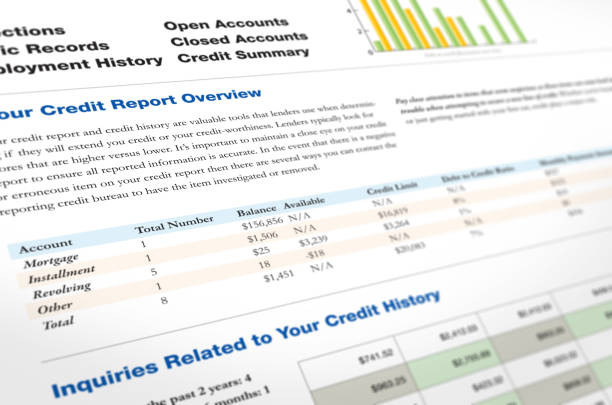

Business credit bureaus compile extensive data from various sources to create comprehensive profiles of commercial entities. They collect information from suppliers, lenders, public records, and other financial institutions to build detailed credit histories. The data gathered by these bureaus directly influences how potential partners and lenders perceive a company’s financial stability and creditworthiness.

Credit scoring mechanisms differ significantly between personal and commercial evaluations, creating unique challenges for business owners. Commercial credit assessments focus on payment patterns with suppliers, legal obligations, and overall financial management practices. These specialized metrics provide lenders with insights into how effectively a company manages its financial responsibilities and operational commitments.

Essential Data Categories Found in Business Credit Reports

- Payment History Records: Business credit reports feature payment patterns with suppliers, vendors, and creditors over extended periods. These records show whether a company consistently meets its financial obligations on time or frequently falls behind on payments. Late payments can severely damage a business’s creditworthiness and limit future financing options for expansion or operational needs.

- Legal Filing Documentation: Public records, including tax liens, judgments, bankruptcies, and other legal actions, appear prominently on business credit reports. These filings provide potential lenders with crucial information about a company’s legal and financial troubles. Even resolved legal issues can remain on reports for several years, continuing to influence credit decisions and lending terms.

- Company Identification Details: Basic information such as business name, address, phone number, industry classification, and years in operation establishes the foundation of every credit report. This data helps verify a company’s legitimacy and operational history. Accurate company details ensure that credit information gets properly attributed to the correct business entity.

Understanding Commercial Credit Scoring Systems

- Scoring Range Variations: Commercial credit scores typically range from 0 to 100, with higher numbers indicating better creditworthiness and a lower risk profile. Different bureaus use varying scales and calculation methods, making it essential for business owners to understand each system. These scores directly impact the loan approval rates, interest rates, and credit limits offered by financial institutions.

- Key Scoring Factors Include These Considerations:

- Payment history with suppliers and creditors accounts for approximately 35% of most scoring models.

- Credit utilization ratios demonstrate how effectively businesses manage available credit lines.

- Length of credit history shows stability and experience in managing financial obligations.

- Public records and legal filings can significantly reduce scores and limit financing options.

- Industry risk factors influence how scores are calculated and interpreted by lenders.

- Score Impact on Financial Decisions: Lenders use business credit scores to determine loan eligibility, interest rates, and credit limits for commercial applications. Higher scores typically result in better loan terms, lower interest rates, and increased borrowing capacity. Companies with poor scores may face loan denials, higher interest rates, or requirements for personal guarantees from business owners.

Trade Account Information and Supplier Relationships

- Trade Account Reporting: Suppliers and vendors report payment experiences to business credit bureaus, creating detailed records of commercial relationships. These accounts show credit limits, payment terms, and actual payment performance over time. Positive trade relationships can significantly improve credit scores and demonstrate reliability to potential lenders and business partners.

- Supplier Payment Patterns: Regular reporting from suppliers creates a comprehensive picture of how businesses manage their operational expenses and vendor relationships. Consistent on-time payments build strong credit profiles, while late or missed payments create negative marks that persist for years. These patterns often predict future payment behavior and financial stability for lending decisions.

Business credit reports serve as the foundation for countless financial decisions that impact company growth and operational success. Understanding the information these reports contain empowers business owners to take proactive steps toward improving their credit profiles and securing better financing terms.

Take action today by requesting copies of your business credit reports from major bureaus and developing strategies to strengthen weak areas in your credit history.

Featured Image Source: https://media.gettyimages.com/id/157681670/photo/credit-report.jpg?s=612×612&w=0&k=20&c=QMy9sH4XGf8hTBqMynD8TZyb6KCTtJWehpw7sobMvsY=